第 158 篇:世界已经改变,并将继续改变

来源:岭南论坛 时间:2024-01-29

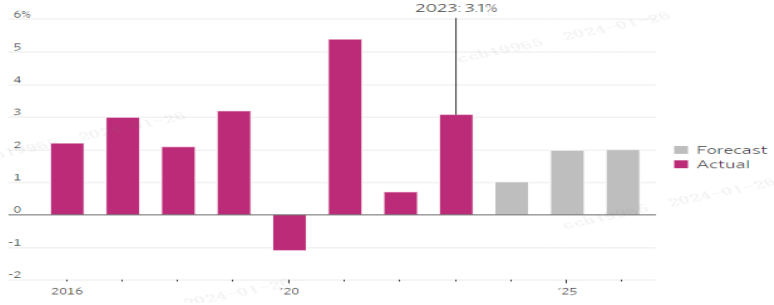

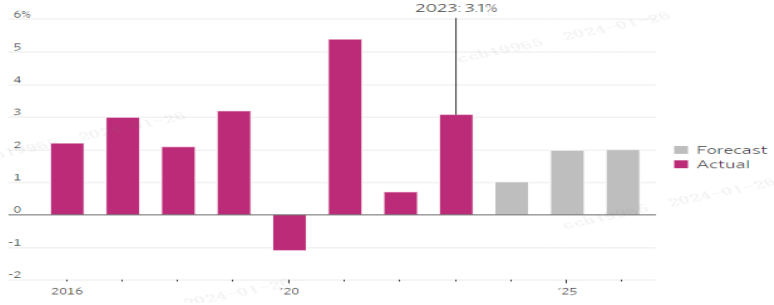

经济衰退。什么衰退?美国经济一反一年多来的 "狼来了",2023 年第四季度 GDP 增长 3.3%(第三季度高达 4.90%),2023 年全年增长 3.1%,强于预期。一年前的一致预测是 2023 年美国 GDP 增长 0.2%,随着 2022 年为令人失望的 0.7%。GDP 数据表明,尽管美联储在 16 个月内将利率从 0%-0.25% 提高到 5.25%-5.50% ,但美国经济仍具有显著的韧性,并巩固了美国作为全球经济增长主要驱动力的地位,在 2023 年成为全球增长最快的发达经济体,并可能在可预见的未来继续保持这一地位。

美国:GDP 年率变化:100% 衰退年最终实现 +3.1% 增长

美联储首选的通胀指标个人消费支出平减指数 PCE Deflator 在 12 月份保持稳定,年同比为2.6%,月环比为 0.2%。美联储的目标是 2.00%。

那些一直 "希望 "2024 年降息 1.50%,并从 3 月份开始降息的人需要进行一些现实检查。在就业强于预期、美国国内生产总值(GDP)远强于预期、通胀率高于美联储 2% 目标的情况下,美联储为何要从 3 月份开始断崖式降息?

在大西洋彼岸,欧央行周四维持创纪录的高利率不变,但仍敞开降息大门。投资者预计首次降息最快将于 4 月开始。

标准普尔 500 指数上周五创下历史新高,本周又创下四个新高。值得注意的是,新高是在 512个交易日后创出的,这是一个漫长的停顿期。创新高之间的漫长时间停顿总是积极的,标志着新的牛市趋势。

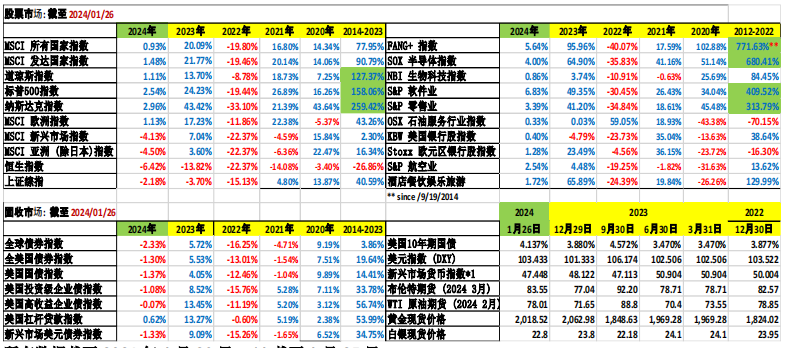

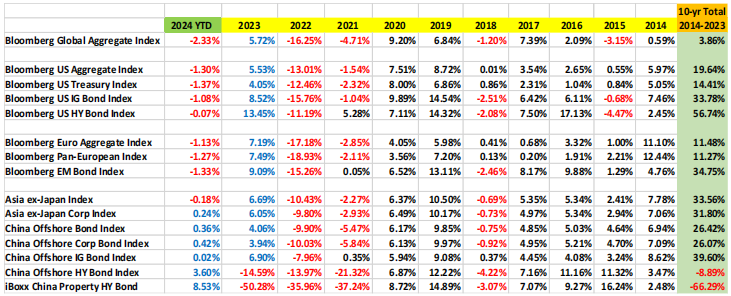

请参阅下表,了解 2024 与往年收益对比情况:

所有数据截至 2024 年 1 月 26 日, *1 截至 1 月 25 日

2024 年,我们将何去何从?

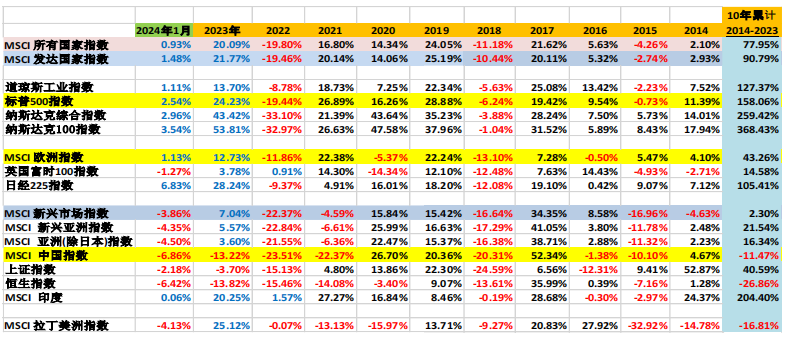

全球股市:

全球股市在 2023 年出现明显分化,并将持续到 2024 年,赢家赢得更多(或全部),输家则受到无情的惩罚。世界已经改变。许多行业和产品一去不复返。押注低估值和重现昔日辉煌是一个低回报的赌注。

美国国内生产总值(GDP)强于预期和通胀率下降让美国人对消费更加乐观,但股市上涨推动股价创下新纪录也是一个同样重要的因素。股价上涨和 "财富效应 "提振了消费者信心。我希望世界其他国家也能从美国的特殊性中吸取教训。如果美国经济在 2024 年继续保持强劲增长,无论是否有最低限度的降息,我都不会感到惊讶。

全球固定收益市场

2024 年已过去四周,大多数全球固定收益市场仍处于负收益区域。2023 年 11 月和 12 月的超额收益(从 2024 年借来的)需要时间来偿还,而降息的 "利好 "已被推后。

芯片,芯片,芯片...

本周一,台积电宣布投资 320 亿美元在台湾新建 1 纳米芯片工厂。此举大大提高了竞争优势。股票分析师称其为 "建立护城河",进入门槛之高有效地将竞争对手拒之门外。不要说 320 亿美元,就是 32 亿美元的资本支出,又有几家公司能承担得起?我认为,台积电不是在建造一座 32 亿美元的工厂,然后祈祷并希望获得客户订单。台积电很可能已经获得了 Nvidia、AMD等公司的订单。

半导体一词永远与英特尔 Intel(先驱)和摩尔定律 Moore’s Law(传奇)联系在一起。然而,好运气并没有到处散播。周四收盘后,英特尔宣布 2023 年第四季度销售额同比下滑 11%。周五,英特尔股价下跌 11.9%,也拖累 半导体 SOX 指数下跌 2.9%。

半导体行业是每个投资组合配置中 "必须拥有 "的行业。然而,除非你拥有行业专业知识和分析能力,否则参与的最佳途径是通过 SOX 指数(有 30 只相关股票)。

正如我上周所写,我预计该行业在 2024 年将再次表现出色,因为人工智能革命将催生各种创新、扩散,并大幅增加对人工智能和通信半导体的需求,将该行业提升到史诗般的规模。

半导体指数自 1994 年推出以来的年度回报率:

本周,微软成为第二家成功突破 3 万亿美元市值的公司,成为全球最有价值的公司。共有七家公司跻身 1 万亿美元俱乐部:3 万亿美元(微软和苹果)、2 万亿美元(沙特阿美)、1 万亿美元(谷歌、亚马逊、英伟达和脸书)。你会注意到,7 家公司中有 6 家与科技有关,所有 6家公司都在美国,而且成立时间都不到 30-40 年。

作者:蔡清福

Alvin C. Chua

2024 年 1 月 28 日星期日

Article #158: The World Has Changed, and Will Continue to Change

Recession. What Recession? The US economy defied more than a year of “crying wolves” by growing stronger than expected 3.3% in Q4 2023 (after a whopping 4.90% in Q3) and 3.1% for the full year 2023. A year ago, the consensus forecast was an anemic 0.2% GDP growth in 2023, after a disappointing 0.7% growth in 2022. The GDP figures pointed to the US economy’s remarkable resilience, despite the Fed raising interest rate from 0%-0.25% to 5.25%-5.50% over a 16-month period, and cemented the US position as the dominant driver of global growth, the world’s fastest-growing advanced economy in 2023, and likely for the foreseeable future.

USA: annual GDP change:The year of 100% recession ended up being +3.1% growth

The Fed’s preferred inflation gauge, the PCE deflator held steady in December at 2.6% YoY and 0.2% MOM. The Fed’s target is 2.00%.

Those who have been “hoping” for a 1.50% rate cut in 2024, starting in March will need to go for some reality check-up. With stronger than expected employment, much stronger than expected GDP, and inflation rate above the Fed’s 2% target, why would Fed cut rates precipitously starting in March?

Across the Atlantic, the ECB kept its record high interest unchanged on Thursday, but kept the door to rate cut open. Investors are anticipating the first rate cut as soon as April.

The S&P500 Index made a new all-time high last Friday, and proceeded to make four new highs this week. It is significant that the new high was made after 512 trading days, which was a long pause. A long pause between record highs is always positive, and signifies a renewed bull trend.

Please refer to the following table for YTD 2024 vs 2023 and prior year performance:

All data as of Jan 26, 2024, *1 as of Jan 25

Where do we go from here in 2024?

Global Equity Markets:

The global equity markets performed with significant divergence in 2023 and continuing into 2024, with winners winning more (or taking all), and losers mercilessly punished. The world has changed. Many industries and products are gone and will not be back. Betting on low valuation and return to previous glory is a low reward bet.

While the stronger than expected GDP and declining inflation have helped Americans feel more upbeat about spending, the stock market rally that has pushed share prices to new records has been an equally important factor. Higher stock prices and the “wealth effect” brighten consumer confidence. I hope the rest of the world can take note of the US exceptionalism. I would not be surprised if the US economy continues to have robust growth in 2024, with or without the minimal rate cuts.

Global Fixed Income Markets:

Four weeks into 2024, most global fixed income markets are still decisively in negative territory. The outperformance in Nov and Dec 2023 (borrowed from 2024) will need time to be repaid, and the rate cut tailwind has been pushed back.

CHIPS, Chips, Chips …

On Monday, TSMC announced it will be investing US$32 billion to build a new 1nm chip plant in Taiwan. The move significantly upped the ante. Equity analysts call it “building a moat.” The barrier to entry is so high that it effectively shuts out competitors. How many companies can afford a US$3.2 billion capital expenditure, not to mention US$ 32 billion. I will reckon that TSMC is not building a US$32 billion plant and then pray and hope for customer orders. It is highly likely that TSMC already received committed orders from Nvidia, AMD, etc.

The word semiconductor is forever linked to Intel (the pioneer) and Moore’s Law (the legend). However, good fortunes are not being spread around. After the market closed on Thursday, Intel announced 11% sales missed in 2023 Q4. On Friday, Intel stock price dropped 11.9%, which also dragged the SOX Index 2.9% lower.

The semiconductor sector is a “must-own” in every portfolio allocation. However, unless you have the industry expertise, and analytical prowess, your best way to participate is via the SOX Index, with 30 underlying stocks.

As I wrote last week, I expect the sector to perform well again in 2024, as the AI revolution will spawn all kinds of innovation, proliferate, and dramatically increase the demand for AI and communications semiconductor, lifting the industry to epic proportions.

Semiconductor Index annual return since 1994 inception:

This week, Microsoft became the 2nd company to successfully scaled the US$3 trillion market cap, and became the most valuable company in the world. There are seven companies in the US$1 trillion club: $3 trillion (Microsoft & Apple), $2 trillion (Aramco of Saudi Arabia), $1 trillion (Google, Amazon, Nvidia, and Meta). You will note that six out of seven are tech-related, and all 6 are domiciled in America, and all were founded less than 30-40 years ago.

By Alvin Chua

Sunday January 28, 2024